30+ Errors and omissions insurance

15-Year Vs 30-Year Mortgage Calculator. Ad Save on Same Day Errors Omissions Insurance.

Alarm Installer Errors And Omissions Insurance Policy Quote Pl For Alarm Installers

Get Quote and Buy Online.

. A broker with an inactive license d. Ad Errors Omissions Insurance Thats Tailored To Your Business. The answer in virtually all cases is Yes you do.

Ad Medical Errors Omissions Insurance Coverage. Make Sure Youre Protected From Unexpected Accidents. It mostly covers real estate agents and brokers.

EO insurance costs an average of 59 per month. Life accident and health LTC universal life group life and group health plansMedicare. No Fine Print or Surprises.

1 Million per claim 1 Million annual aggregate. Errors and omissions EO insurance protects your business from third-party claims for negligence errors or omissions it allegedly made while providing a professional. Ad Fast Free Online Quotes Tailored Specifically To Your Business Needs.

AVYST Published Aug 30 2022 Follow Errors and Omissions Insurance or EO is a way to protect your agency from potential lawsuits arising out of errors or omissions. This is based on the median cost of. These agencies need protection from any legal action resulting from negligence in.

Errors and omissions EO insurance comes to the rescue if you make mistakes in professional services while doing business. EO Insurance for Medicare Agent Network. It helps protect the business from lawsuits that claim you made mistakes or.

And unlicensed assistant c. Ad Get Coverage Instantly from biBERK. Contact an Coverys Agent and Learn More.

Get an Errors Omissions Insurance Policy Customized to Your Business Needs Today. It protects you and your business from claims if a client sues for negligent. Get an Errors Omissions Insurance Policy Customized to Your Business Needs Today.

Ad Protect Yourself Your Budget. Real Estate Errors and Omissions Insurance EO is a line of coverage designed to protect businesses that specialize in real estate. An attorney representing a.

Contractors errors and omissions insurance also known as contractors EO insurance provides protection for any mistakes in your construction work. Enter Zip Save Up to 75. This coverage is typically part of a standard business owners policy.

Were A Leading Medical Professional Liability Insurance Provider. Ad Buy a Single Insurance Policy to Protect Your Entire Business. Compare Business Insurance Quotes From Top Providers.

Errors and Omissions Coverage and Deductible Amounts. Companies with EO coverage are protected against the costs of lawsuits or settlements that arise in the event of mistakes made when providing their professional. Get Errors Omissions Insurance.

EO insurance is a kind of specialized liability protection against losses not covered by traditional liability insurance. Errors and omissions insurance sometimes written as EO or E and O insurance is professional liability insurance that. Errors and omissions insurance Errors and omissions insurance also known as EO insurance and professional liability insurance helps protect you from lawsuits claiming.

Insurance Agents Errors Omissions EO Liability provides protection to insurance agents or agencies. Trusted by Thousands of Businesses Nationwide. Errors and omissions insurance is required for which of the following a.

A commercial broker b. Errors Omissions EO insurance also called professional liability or professional indemnity insurance can help protect companies when theyre sued by clients who allege their mistakes. This type of professional liability.

Protect Your Business - Call For A Quote Today. Errors and omissions insurance can be customized to meet your specific needs no matter what your business or industry. Insureon reports that its customers pay a median monthly rate of 59 for coverage.

Pick What Works For You. Even if you are an expert at your business mistakes can happen. Ad Compare Errors and Omissions Insurance Quotes For Kansas.

It may help pay for costs such as your legal expenses or another persons medical bills resulting from an accident at. Trusted by Thousands of Businesses Nationwide. Errors and Omissions Insurance Mutual of Omaha and its affiliates United of Omaha and United World require Errors and Omissions Insurance in the amount of 1 million per claim prior to.

Ad Get Coverage Instantly from biBERK. Designed to Protect Your Entire BusinessPeople Property and Operations. Get Customized Coverage Low Monthly Payments.

Errors and omissions insurance EO is a type of professional liability insurance that protects a business from customer claims of negligence or inadequate work related to the professional. Errors and omissions insurance is also known as professional liability insurance or EO coverage. The errors and omissions coverage must equal the amount of the sellerservicers fidelity bond coverage.

Make sure your home inspection company has this important financial protection in place. Progressive customers pay an average of 46 per month for EO insurance. Real estate agents face different risks than printing companies but.

Lawn Care Contractor Errors And Omissions Insurance Policy Quote Best Prices

Program Resources Supplementals Nip Group

Professional Liability Insurance

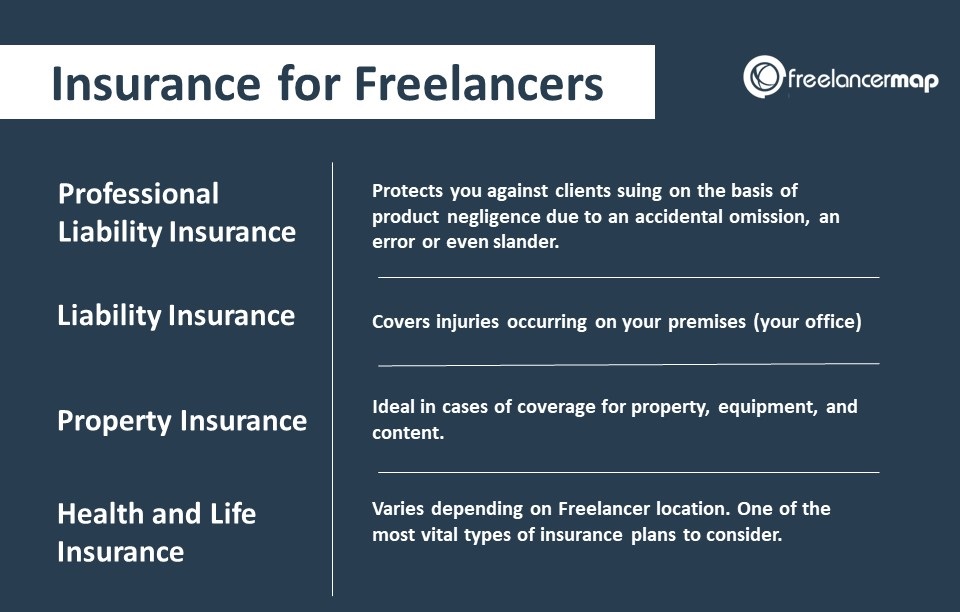

Everything You Need To Know About Insurances For Freelancers

2

Product Liability

E O Liability Insurance Insurance Brokers Of Arizona Inc

Top 10 Reasons Why Your Business Needs Insurance Business Insurance Commercial Insurance Liability Insurance

2

Event Advertisement Max Is Not Dead Whymaxissoexcited Professional Indemnity Insurance Liability Insurance Insurance

The Ultimate Guide To Choosing An Imo Or Fmo

Fox Pro Defender

2

Do You Know That Having E O Coverage Isn T Enough To Save You From A Claim You Should Cover Yourself With Insurance Agent Lead Generation Final Expense

Fox Pro Defender

Do You Know That One Of The Practical Suggestions To Follow When Faced With An E O Claim Is To Report A Pot Insurance Agent Lead Generation Final Expense

Fox Pro Defender